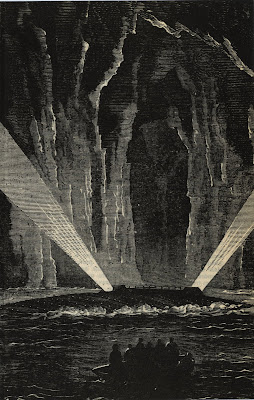

Last week, I took a small position in an exploration stage company called "Nautilus Minerals" (TSX/AIM: NUS). I am typically not interested in exploration stage companies, but this particular company does something that at first sounds like sci-fi: Their first mine will be located 1600 meters below the surface of Pacific Ocean near Papua New Guinea. In fact, long ago it was sci-fi. Jules Verne envisioned underwater mine in his book "Twenty Thousand Leagues under the Seas" back in 1870. I haven't read it, but I sure am familiar with Captain Nemo and Nautilus (the submarine) that were introduced by this book. It seems that Nautilus Minerals have taken their name from Nautilus the marine creature (not the sub) based on their logo.

The Nautilus, as pictured in "The Mysterious Island". Source: Wikipedia.

Oil and gas industry went offshore in the 1940s and now it might be the time for mining companies to do the same. Nautilus Mining will use existing offshore oil technologies to cut ore from the seafloor and pump it to the surface as seawater slurry. Once the ore is dewatered, it will be shipped to shore for processing.

Recently published independent engineering study titled "offshore production system definition and cost study" related to the first ever underwater mine "Solwara 1" reveals some very interesting things. Indicated and inferred resources combined and valued at market prices for metals put the mineral deposit somewhere around 1,6 billion USD (at the time of writing). Most of this is copper (about 1 billion USD) and gold (about half a billion). Extraction requires 383 million USD capital expenses and approximately 150 million operating expenses (estimated based on $70 USD per tonne OPEX). The difference of resource value minus direct CAPEX and OPEX is over 1 billion USD. Naturally not all of this can be clarified as profit as there are other expenses involved in the process (such as smelting and refining).

Nautilus Minerals has about 169 million shares outstanding (diluted) and 196 million USD in cash (additional 40,7 million USD if all options etc. are excercised). The required CAPEX needs to come from somewhere. Either they have to issue more shares or then they need to sell some of the future revenue for cash today. So let's assume they sell more shares. Let's further assume that they can cover this by issuing 131 million shares putting total shares outstanding to 300 million.

Now, to justify the current share price of 2.11 CAD (about 2.05 USD) they would need to be able to make profits in the range of 600 million (net present value of future profits). If successful and completed within the CAPEX and OPEX estimates, the Solwara 1 alone should give this kind of profit with a healthy margin for error.

Yes, there are some very big IFs since this is a pioneering project. There are also big risks that the whole concept of underwater mining comes under attack for environmental or other reasons although the company claims that the environmental and social impacts are smaller than those associated with conventional land based mines. Also, between now and the completion of the mine, the company will have negative cash flow (Q1 2010: -13,3 million USD) due to exploration and other operating costs that are not related to mineral extraction from Solwara 1.

Solwara 1 was granted environmental permit in December 2009 and the company is expecting to have the mining lease in place during 2010. The company has over 450.000 square kilometers of tenements in five jurisdictions. There are many other high grade mineral deposits already found besides the Solwara 1.

Recently the stock has gained a lot and has been trading with wild daily swings up and down.

Great summary! I have been following NUS for more than three years now and am captivated by the premise.

ReplyDeleteI have a couple of comments:

It looks like the company is not going to issue more shares, preferring to partner with another entity. They are in "very advanced" negotiations with two companies right now.

I have been crunching the production numbers, based on the best available information reported by the company itself. I estimate the annual revenue at $1.193 billion per year. With costs estimated at $150/ton and padding in $300 million per year in additional CAPEX/OPEX I get a profit of $653 million per year. With 155,600,000 shares outstanding, and using a lowball 10 PE, this equates to a shareprice of $41.98 per share, once things get rolling. If I'm incorrect on this valuation, I would be more than happy to share my analysis for review.

As you say, there are a lot of risks, but with a > 20x potential upside, this seems to be well worth the risk at today's price.

Hate to mention it, but it looks like the stock's been heavily manipulated: http://www.jcamberger.com/2010/09/when-push-comes-to-pump-whatever-happened-to-underwater-gold-sands/

ReplyDeleteMost certainly it has been manipulated. A big block of trades were executed in late June, then the pump-and-dump debacle, and subsequent drift back down.

ReplyDeleteUnfortunately it seems these type of small and illuquid companies are vulnerable to pump and dump schemes. However, I typically disconnect the stock price movements from the company in itself. For Nautilus Minerals it is hard to say what is the correct price that should be paid for it. That is why I called it a lottery ticket. The same is true for any mining company in the similar position (not producing).

ReplyDeleteHowever, I am willing to risk all my money in this position in the hope that they actually do what they said they will. Then the company can easily be a tenbagger or more. If it does not work out, the company is not worth much.

See also later post:

ReplyDeleteNautilus Minerals revisited:

http://thoughtsofaprivateinvestor.blogspot.com/2011/06/nautilus-minerals-revisited.html

How do you conduct do-diligence on an industry stock that has no peers that have produced yet? There is no model. The mining equipment is science fiction. There is nothing but drill results to digest. Everything else is faith. You can't compare these reserves to a mine on land.

ReplyDeleteAt $1800 gold we are looking, but not going to tie up any funds as it is.

Took a position in Nautilus around 9 months ago at $3 per share and it's currently around $2. We are about 15 months away from the launch of the ship so I would say the last quarter of this year is when increased interest in this venture will pick up.

ReplyDeleteCertainly $2 is a potentially great entry price for anyone who likes a gamble as this could have huge returns and there are 3 big investors in the Company who may be interested in buying Nautilus out should the project prove successful.

I for one am extremely confident that my current paper loss, on my investment, will turn around in a hurry during the next 9 months.

It looks like my definition "lottery ticket" was quite fitting one. For the last two years the stock price has been trending down and is now below C$0.50.

ReplyDeleteThe most serious headwind comes from dispute with state of PNG over Solwara 1 which has been their flagship project. It looks like that one won't fly. They have plenty of other prospects, but time is money so I have very low expectations for this company at the moment. Have so little in the position that I don't at the moment bother to sell. Interesting company anyway as the pioneer of underwater mining, so I continue watching this one..

Press releases from the company related to Solwara 1 :

November 13, 2012 Nautilus Minerals terminates equipment build for its Solwara 1 Project

July 17, 2012 Nautilus aims to resolve dispute

June 20, 2012 Further Update on Dispute Process with State of PNG

June 18, 2012 Nautilus continues discussions to resolve dispute with State of PNG

June 01, 2012 Nautilus dispute with the State of PNG